Student debt boom

*

Sandy Nurse doesn’t see why she needs to be $120,000 in debt “just for trying to improve my understanding of the world.”

And so, after a decade of struggling to repay her student loans, she plans to stop trying. She hopes others will join her, too, in a national strike against the USA’s outstanding student loan debt, which is marching toward $1.7 trillion.

“It’s a way not to look at ourselves as failures because we’re failing to pay back an excessive amount of money for knowledge,” said Nurse, who has founded nonprofits and is running for a City Council seat in Brooklyn, New York. “It’s a way to share our experiences and to think about how the system is failing all of us.”

Earlier this month, at the University of California, Los Angeles, the Debt Collective, an organization founded by a group of activists who met during the Occupy Wall Street movement of nearly a decade ago, called on people with student debt to stop paying it. At the event, dozens of people lit their student loan bills on fire.

The group’s goal is to get all private and federal student loans canceled and to make public college free. Needless to say, the left-wing extremist uncle Joe Stalin would be proud of them.

Senator Bernie Sanders and Senator Elizabeth Warren have already vowed to try to wipe out all or the majority of education debt.

*

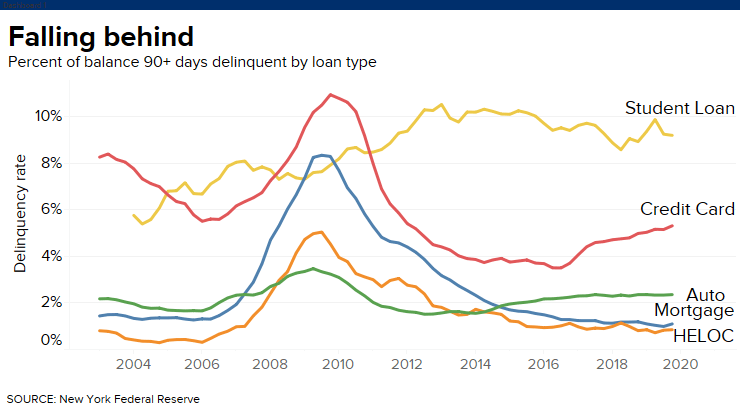

Falling behind

*

The country’s unpaid student loan debt has long surpassed credit card debt or auto loan balances and is second only to mortgages. The average balance today is around $30,000, up from $10,000 in the 1990s.

As student loan bills have climbed, incomes haven’t. The average hourly wage in 2018 had no more purchasing power than it did in 1978, according to the Pew Research Center. That math backs many borrowers into a corner.

“I have to either pay my rent and get health care, or pay down my loans,” said Nurse, who got her bachelor’s degree in political science from Emmanuel College in Boston. “It’s one of the reasons I don’t even think about having children. How can anyone afford it?”

The Debt Collective wants people to stop having to make these choices. Thomas Gokey, the co-founder of the Debt Collective, said the movement aims to “politicize” the millions of Americans who already are not repaying their student debt because they can’t.

Nearly 30% of borrowers are in delinquency or default. Five years out of school, just half of the people with student debt have paid even $1 toward their principal, or the amount they originally borrowed, according to the U.S. Department of Education.

The share of federal financial aid going to for-profit schools nearly doubled between 1996 and 2012, and today they take in around 15% of the government’s aid. More than a decade after leaving for-profit schools, more than half of their student borrowers default on their loans.

*

Ms. Sandy Nurse doesn’t have to worry too much – Capt. Jay is already coming to the rescue.

*

LEGAL DISCLAIMER:

While the author has made every effort to provide accurate data and information in the preparation of this article, neither europabullion.com nor the author assumes any responsibility for errors or for changes that occur after the publication. The information referenced is believed to be reliable, accurate, and appropriate, but is not guaranteed in any way. The strategies and forecasts herein are the author’s sole opinion and could prove to be inaccurate. No company, individual, or entity compensated the author or europabullion.com for mention in this article.

The article contains specific names of companies, strategies, different currencies, shares, government bonds, types, and sizes of precious metals, none of which can be deemed recommendations to the readers. Reading this article does not constitute a fiduciary relationship. Data, company-specific or otherwise, will not be updated on an ongoing basis. After the publication of the resources, the author and europabullion.com will not be responsible for future developments.

A registered financial advisor is always the best source of guidance in making financial decisions. The author is not a registered financial advisor and does not address the individual financial condition of the reader.