THE GREAT DEFINANCIALIZATION

By Parker Lewis

*

Or maybe just get a grip on the real money?

*

Have you ever had a financial advisor (or maybe even a parent) tell you that you need to make your money grow? This idea has been so hardwired in the minds of hard-working people all over the world that it has become practically second nature to the very idea of work.

The line has been repeated so many times that it is now a de facto part of the working culture. Get a salaried position, max out your 401-K contribution (maybe your employer matches 3 %!), select a few mutual funds with catchy marketing names, and watch your money grow. Most folks navigate this path every two weeks on auto-pilot, never questioning the wisdom nor being conscious of the risks. It is just what “smart people” do. Many now associate the activity with savings but in reality, financialization has turned retirement savers into perpetual risk-takers and the consequence is that financial investment has become a second full-time job for many, if not most.

Financialization has been so errantly normalized that the lines between saving (not taking risk) and investing (taking risk) have become blurred to the extent that most people think of the two activities as being one at the same. Believing that financial engineering is a necessary path to a happy retirement might lack common sense, but it is conventional wisdom.

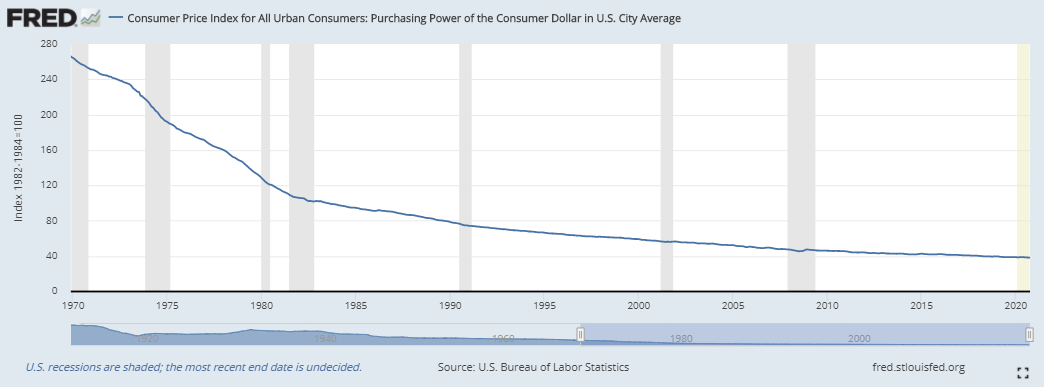

Over the course of the past several decades, economies everywhere, but particularly those in the developed world (and specifically the United States), have become increasingly financialized. Increased financialization has become the necessary companion to the idea that you must make your money grow. But the idea itself — that ‘you must make your money grow’ — only really emerged in the mainstream consciousness as everyone similarly became conditioned to the unfortunate reality that currency loses its value over time.

*

Currency Loses Value → Need to Make Savings Grow → Need Financial Products to Make Savings Grow → Repeat.

*

Purchasing Power of the U.S. Dollar Over Time (1970 to 2020)

**

The extent to which the need even exists is largely a function of a currency losing its value over time; that is the starting point, and the most unfortunate part is that central banks intentionally engineer this outcome. Most global central banks target the devaluation of their local currencies by approximately 2% per year and do so by increasing the money supply. How or why is less relevant; it is a reality and there are consequences. Rather than simply being able to save for a rainy day, future retirement funds are invested and put at constant risk, often just as a means to keep up with the very inflation manufactured by central banks.

The demand function is perversely driven by central banks devaluing currency to induce such investments. An over-financialized economy is the logical conclusion of monetary inflation, and it has induced perpetual risk-taking while disincentivizing savings. A system that disincentivizes saving and forces people into a position of risk-taking creates instability that is neither productive nor sustainable. It should be obvious to even the untrained eye, but the overarching force driving the trend toward financialization and financial engineering more broadly is the broken incentive structure of the monetary medium which underpins all economic activity.

At a fundamental level, there is nothing inherently wrong with joint-stock companies, bond offerings, or any pooled investment vehicle for that matter. While individual investment vehicles may be structurally flawed, there can be (and often is) value created through pooled investment vehicles and capital allocation functions. Pooled risk isn’t the issue, nor is the existence of financial assets. Instead, the fundamental problem is the degree to which the economy has become financialized, and that it is increasingly an unintended consequence of otherwise rational responses to a broken and manipulated monetary structure.

What happens when hundreds of millions of market participants come to understand that their savings are artificially, yet intentionally, engineered to lose 2% of its value every year? It is either to accept the inevitable decay or try to keep up with inflation by taking an incremental risk. And what does that mean? Cash must be invested, meaning it must be put at risk of loss. Because monetary debasement never abates, this cycle persists. Essentially, people take risks through their “day” jobs and are trained to put any money they do manage to save at risk, just to keep up with inflation, if nothing more. It is the definition of a hamster wheel. Run hard just to stay in the same place. It may be insane but it is the present reality. And it is not without consequence.

*

The Dollar Hamster Wheel

*

Savings vs. Risk

*

While the relationship between savings and risk is often misunderstood, risk must be taken in order for any individual to accumulate savings in the first place. Risk comes in the form of investing time and energy in some pursuit that others value (and must continue to value) in order to be paid (and continue to be paid). It starts with education, training, and ultimately perfecting a craft over time that others value.

That is risk-taking. Investing time and energy in an attempt to earn a living and to produce value for others, while also implicitly accepting high degrees of future uncertainty. If successful, it ends with a classroom of students, a product on a shelf, a world-class performance, a full day of hard manual labor, or anything else that others value. The risk is taken on the front end with the hope and expectation that someone else will compensate you for your time spent and value delivered.

Compensation typically comes in the form of money because money, as an economic good, allows individuals to convert their own value into a wide range of value created by others. In a world in which money is not manipulated, monetary savings would best be described as the difference between the value one has produced for others and the value one has consumed from others. Savings is simply consumption or investment deferred into the future; or said another way, it represents the excess of what one has produced but not yet consumed. That however is not the world that exists today. With modern fiat money, there is a fly in the ointment.

Central banks create more and more fiat money which causes savings to be perpetually devalued. The entire incentive structure of fiat money is manipulated, including the integrity of the scorecard that tracks who has created and consumed what value. The value created today is ensured to purchase less in the future as central banks allocate more units of the currency arbitrarily. Money is intended to store value, not lose value and with monetary economics engineered by central banks, everyone is unwittingly forced into the position of taking a risk as a means to replace savings as it is debased. The unending devaluation of monetary savings forces unwanted and unwarranted risk-taking on those that make up the economy. Rather than simply benefiting from risks already taken, everyone is forced to take the incremental risk.

Forcing risk-taking on practically all individuals within an economic system is not natural nor is it fundamental to the functioning of an economy. It is the opposite and it is detrimental to the stability of the system as a whole. As an economic function, risk-taking itself is productive, necessary, and inevitable. The unhealthy part is specifically when individuals are forced into taking risks as a byproduct of central banks manufacturing money to lose value, whether those taking risk are conscious of the cause and effect or not. Risk-taking is productive when it is intentional, voluntary, and undertaken in the pursuit of accumulating capital.

While deciphering between productive investment and that which is induced by monetary inflation is inherently grey, you know it when you see it. Productive investment occurs naturally as market participants work to improve their own lives and the lives of those around them. The incentives to take risks in a free market already exist. There is nothing to be gained, and a lot to lose, through central bank intervention.

The operation of risk-taking becomes counterproductive when it is born more out of a hostage-taking situation than it is free will. That should be intuitive and it is exactly what occurs when the investment is induced by monetary debasement. Recognize that 100% of all future investment (and consumption for that matter) comes from savings. Manipulating monetary incentives, and specifically creating a disincentive to save, merely serves to distort the timing and terms of future investment.

It forces the hand of savers everywhere and unnecessarily lights a shortened fuse on all monetary savings. It inevitably creates a game of hot potatoes, with no one wanting to hold money because it loses value when the opposite should be true. What kind of investment do you think that the world produces? Rather than having a proper incentive to save, the melting ice cube of central bank currency has induced a cycle of perpetual risk-taking, whereby the majority of all savings are almost immediately put back at risk and invested in financial assets, either directly by an individual or indirectly by a deposit-taking financial institution. Made worse, the two operations have become so sufficiently confused and conflated that most people consider investments, and particularly those in financial assets, as savings.

Without question, investments (in financial assets or otherwise) are not the equivalent of savings and there is nothing normal or natural about risk-taking induced by central banks which creates a disincentive to save. Anyone with common sense and real-world experience understands that. Even still, it doesn’t change the fact that fiat money loses its value every year (because it does) and the knowledge of that fact very rationally dictates behavior. Everyone has been forced to accept a manufactured dilemma. The idea that you must make your money grow is one of the greatest lies ever told. It isn’t true at all. Central banks have created that false dilemma. The greatest trick that central banks ever pulled was convincing the world that individuals must perpetually take risks just to preserve value already created (and saved). It is insane, and the only practical solution is to find a better form of money that eliminates the negative asymmetry inherent to systemic currency debasement.

*

The Great Financialization

*

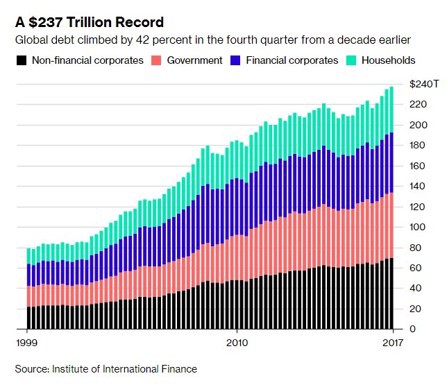

Whether one considers the game to be rigged or simply acknowledges that persistent monetary debasement is a reality, economies all over the world have been forced to adapt to a world in which money loses its value. While the intention is to induce investment and spur growth in “aggregate demand,” there are always unintended consequences when economic incentives become manipulated by exogenous forces. Even the greatest cynic probably wishes that the world’s problems could be solved by printing fiat money, but then again, only kids believe in fairy tales. Rather than print money and have problems magically disappear, the proverbial can has been kicked down the road time and time again. Economies have been structurally and permanently altered as a function of fiat money creation.

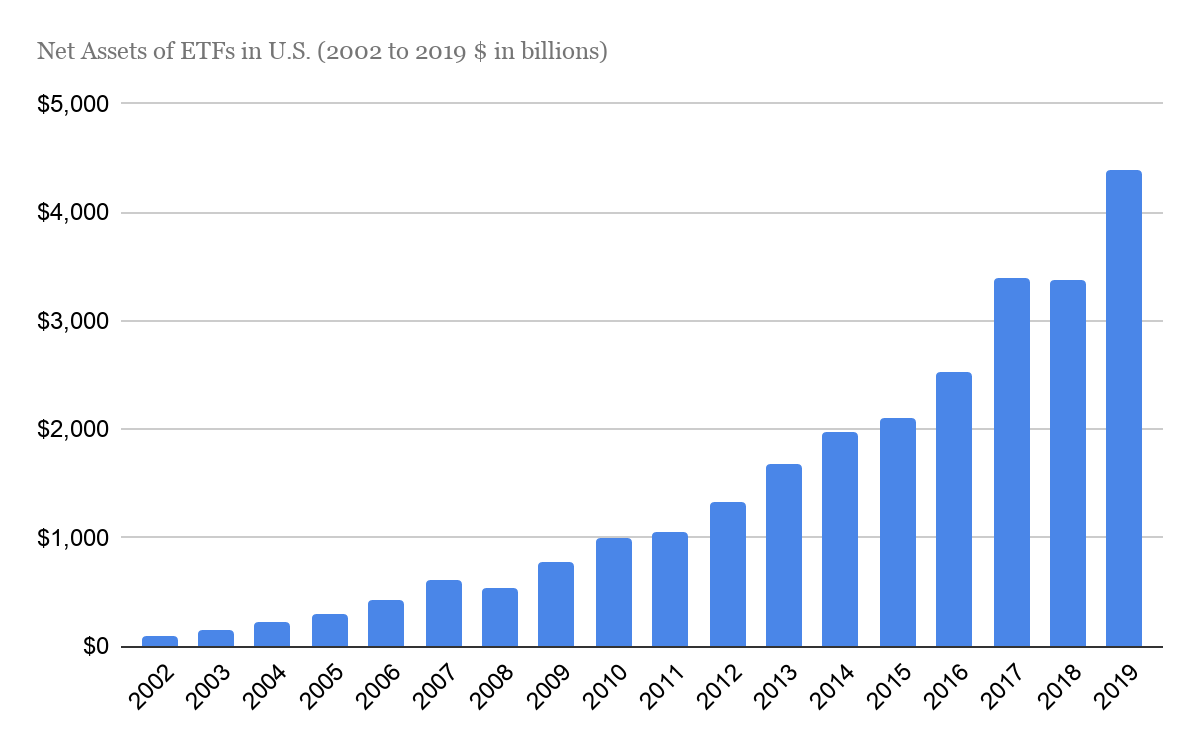

The Fed might have thought it could print fiat money as a means to induce productive investment, but what it actually produced was malinvestment and a massively over-financialized economy. Economies have become increasingly financialized as a direct result of monetary debasement and the impact that has had in manipulating the cost of credit. One would have to be blind not to see the connection: the necessary cause and effect between money manufactured to lose its value, a disincentive to hold money, and the rapid expansion of financial assets, including within the credit system.

*

*

Banking and wealth management industries have metastasized by this same function. It is like a drug dealer that creates his own market by giving the first hit away for free. Drug dealers create their own demand by getting the addict hooked. That is the Fed and the financialization of the developed world economy via monetary inflation. By manufacturing fiat money to lose value, markets for financial products emerge that otherwise would not. Products have emerged to help people financially engineer their way out of the very hole created by the Fed. The need arises to take risks and to attempt to produce returns to replace what is lost via monetary inflation.

*

*

The financial sector has captured a larger percentage of the economy over time because there is greater demand for financial services in a world in which fiat money is constantly impaired. Stocks, corporate bonds, treasuries, sovereign bonds, mutual funds, equity ETFs, bond ETFs, levered ETFs, triple-levered ETFs, fractional shares, mortgage-backed securities, CDOs, CLOs, CDS, CDX, synthetic CDS/CDX, etc. All of these products represent the financialization of the economy, and they become more relevant (and in greater demand) when the monetary function is broken.

Each incremental shift to pool, package and repackage risk can be tied back to the broken incentive structure inherent to the money underpinning an economy and the manufactured need to make money grow. Again, it is not to say that certain financial products or structures do not create value; instead, the problem is that the degree to which financial products are utilized and the extent to which risk has been layered on top of risk is largely a function of an intentionally broken monetary incentive structure.

*

*

While the vast majority of all market participants have been lulled to sleep as the Fed has normalized its 2% per year inflation target, consider the consequence of that policy over a decade or two decades. It represents a compounded 20% and 35% loss of monetary savings over 10 or 20 years, respectively. And that is the case if the provided numbers are correct. History shows that politicians just love to lie about inflation. What would one expect to occur if everyone, society-wide, were collectively put in a position of needing to recreate or replace 20 to 35% or higher of their savings just to remain in the same place?

The aggregate impact is massive malinvestment; investment in activities that would not have occurred if people were not forced into a position of taking ill-advised risk merely to replace the expected future loss of current savings. On an individual level, it is the doctor, nurse, engineer, teacher, butcher, grocer, builder, etc. being turned into a financial investor, plowing the majority of their savings into Wall St. financial products that bear risk while perceiving there to be none. Over time, stocks only go up, real estate only goes up, and interest rates only go down.

*

It is an ancient wisdom that stocks only go up...

*

How or why is a mystery to the Davey Day traders of the world, and it matters not, because that’s just the way the world is perceived to work, and everyone acts accordingly. Rest assured, it will all end badly, but most individuals have come to believe investments in financial assets are just a better (and necessary) way to save, which dictates behavior. A “diversified portfolio” has become so synonymous with savings that it is not perceived to bear risk, nor is it perceived to be a risk-taking activity. While that couldn’t be further from the truth, the choice is either to take risk via investments or to leave savings in a monetary medium that is sure to purchase less and less in the future. From an actual savings perspective, it is where damned if you do meets damned if you don’t. It is an unnerving game that everyone is either forced to play or sit it out and loses either way.

*

Consequences of a Disincentive To Save

*

Forcing everyone to live in a world in which fiat money loses value creates a negatively reinforcing feedback loop; by eliminating the very possibility of saving fiat money as a winning proposition, it makes all outcomes far more negative in aggregate. Just holding fiat money is a non-credible threat when fiat money is engineered to lose its value. People still do it, but it’s a losing hand by default. So is perpetual risk-taking as a forced substitute to saving. Effectively, all hands become losing hands when one of the options is not winning by saving fiat money. Recall that each individual with fiat money has already taken the risk to get it in the first place. A positive incentive to save (and not invest) is not equivalent to rewarding people for not taking risks, quite the opposite. It is rewarding people who have already taken risks with the option of merely holding fiat money without the express promise of its purchasing power declining in the future.

In a free market, money might increase or decrease in value over a particular time horizon, but guaranteeing that money loses value creates an extremely negative outcome, where the majority of participants within an economy lack actual savings. Because money loses its value, the opportunity cost is often believed to be a one-way street. Spend your money now because it is going to purchase less tomorrow. The very idea of holding cash (formerly known as saving) has been conditioned in mainstream financial circles to be a near crazy proposition as everyone knows that money loses its value. How crazy is that? While money is intended to store value, no one wants to hold it because the predominant currencies used today do the opposite. Rather than seek out a real form of money, almost everyone just tries to invest instead!

*

“I still think that cash is trash relative to other alternatives, particularly those that will retain their value or increase their value during reflationary periods”

Ray Dalio (April 2020)

*

Even the most revered Wall St. investors are susceptible to getting caught up in the madness and can act a fool. Risk-taking for inflation’s sake is no better than buying lottery tickets, but that is the consequence of creating a disincentive to save. Economic opportunity cost becomes harder to measure and evaluate when monetary incentives are broken. Today, decisions are rationalized because of broken incentives. Investment decisions are made and financial assets are often purchased merely because the dollar is expected to lose its value. But, the consequence extends far beyond savings and investment. Every economic decision point becomes impaired when money is not fulfilling its intended purpose of storing value.

All spending versus savings decisions, including day-to-day consumption, become negatively biased when money loses its value on a persistent basis. By reintroducing a more explicit opportunity cost to spending money (i.e. an incentive to save), everyone’s risk calculus necessarily changes. Every economic decision becomes sharper when money is fulfilling its proper function of storing value. When a monetary medium is credibly expected to maintain value at minimum, if not increase in value, everyone spends versus save decision becomes more focused and ultimately informed by a better-aligned incentive structure.

*

“One of the greatest mistakes is to judge policies and programs by their intentions rather than their results”

Milton Friedman

*

It is a world that Keynesian economists fear, believing that investments will not be made if an incentive to save exists. The flawed theory goes that if people are incentivized to “hoard” money, no one will ever spend money, and investments deemed “necessary” will not be made. If no one spends money and risk-taking investments are not made, unemployment will rise! It truly is economic theory reserved for the classroom; while counterintuitive to the Keynesian, risk will be taken in a world in which savings are incentivized.

Not only that, the quality of investment will actually be greater as both consumption and investment benefit from undistorted price signals and with the opportunity cost of money being more clearly priced by a free market. When all spending decisions are evaluated against an expectation of potentially greater purchasing power in the future (rather than less), investments will be steered toward the most productive activities and day-to-day consumption will be filtered with greater scrutiny.

Conversely, when the decision point of investment is heavily influenced by not wanting to hold dollars, you get financialization. Similarly, when consumer preferences are guided by the expectation that money will lose its value rather than increase in value, investments are made to cater toward those distorted preferences. Ultimately, short-term incentives beat out long-term incentives; incumbents are favored over new entrants, and the economy stagnates, which increasingly fuels financialization, centralization, and financial engineering rather than productive investment. It is cause and effect; intended behavior with unintended but predictable consequences.

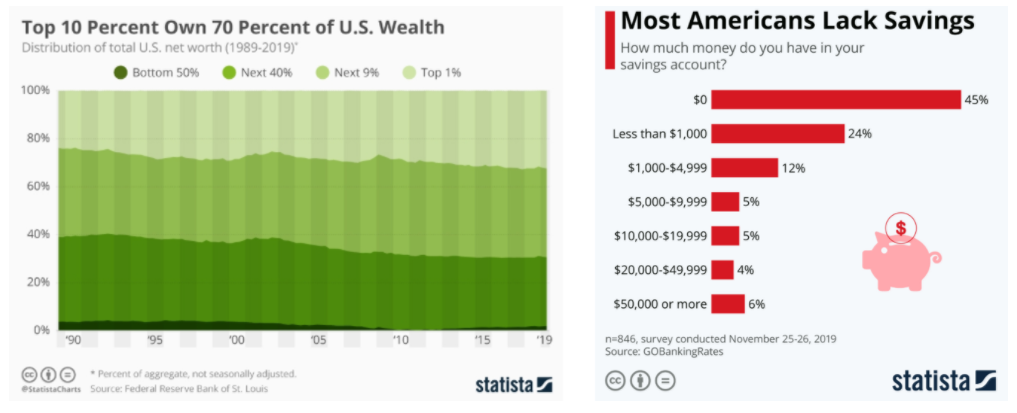

Make money lose its value and people will do dumb $hit because doing dumb $hit becomes more rational, if not encouraged. People that would otherwise be saving are forced to take the incremental risk because their savings are losing value. In that world, savings become financialized. And when you create the incentive not to save, do not be surprised to wake up in a world in which very few people have savings. The empirical evidence shows exactly this, and despite how much it might astound a tenured economics professor, the lack of savings induced by a disincentive to save is very predictably a major source of the inherent fragility in the legacy financial system.

*

Most Americans lack savings.

*

While Keynesians worry that appreciating money will disincentivize consumption and investment in favor of savings and to the detriment of the economy at large, the free market actually works better in practice than it does when applying flawed Keynesian theory. In practice, money that is appreciating will be used every day to facilitate consumption and investment because there is an incentive to save, not despite that fact. The high present demand for both consumption and investment is dictated by positive time preference and there is an express incentive to save; everyone is always trying to earn everyone else’s money and everyone needs to consume real goods every day.

There is and always has been a fundamental difference between saving and investment; savings are held in the form of monetary assets and investments are savings that are put at risk. The lines may have been blurred as the economic system financialized, but money with the right incentive structure will overwhelm demand for complex financial assets and debt instruments.

*

LEGAL DISCLAIMER:

While the author has made every effort to provide accurate data and information in the preparation of this article, neither europabullion.com nor the author assumes any responsibility for errors or for changes that occur after the publication. The information referenced is believed to be reliable, accurate, and appropriate, but is not guaranteed in any way. The strategies and forecasts herein are the author’s sole opinion and could prove to be inaccurate. No company, individual, or entity compensated the author or europabullion.com for mention in this article.

The article contains specific names of companies, strategies, different currencies, shares, government bonds, types, and sizes of precious metals, none of which can be deemed recommendations to the readers. Reading this article does not constitute a fiduciary relationship. Data, company-specific or otherwise, will not be updated on an ongoing basis. After the publication of the resources, the author and europabullion.com will not be responsible for future developments.

A registered financial advisor is always the best source of guidance in making financial decisions. The author is not a registered financial advisor and does not address the individual financial condition of the reader.