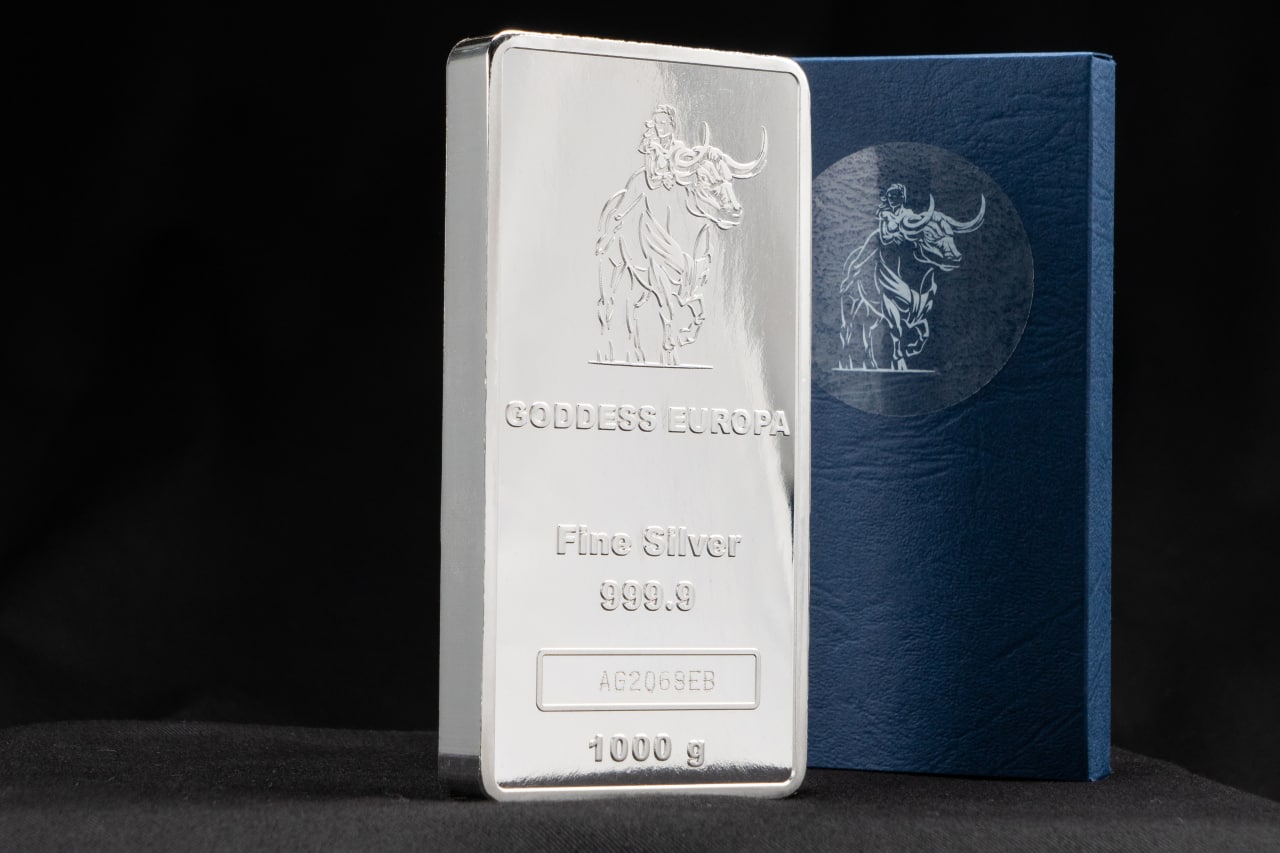

1 KG GODDESS EUROPA SILVER COIN BAR 999.9

*

Silver has benefitted from a buyout of the physical market and will continue to do so moving forward.

*

Silver has remained in the spotlight for several reasons. Kicking off the beginning of the year was a historic level of volatility in the physical silver space, with coordinated attention coming from Reddit via Wall Street Silver.

This saw Silver prices spike to a yearly high in mid-February, 2021, overtaking the $30 handle briefly. Since then, however, prices have failed to retake this key level as momentum during the surge seemingly stalled out.

*

Why the Silver Price Surge Could Just be Getting Started

*

What exists now in the Silver market is a very unique phenomenon. This is due in large part to the physical market being virtually nonexistent, with supply running dangerously thin since the buyout earlier of the year.

As such, there remains very little physical Silver for purchase, which in tandem with a catalyst could trigger a massive surge higher in the near- or mid-term.

Of course, much of the Silver trade also takes place in the form of exchange-traded funds (ETFs), namely iShares Silver Trust (NYSE: SLV). However, more and more clients are dumping their positions and getting into the physical market.

After peaking at $30 in February 2021, silver spot prices retreated as low as $24 days later before finding firm support. What this tells us that there is a clear floor to upper prices, with this serving as a key metric for ensuring a consequent bull run.

*

*

Since hitting this level on February 4, silver prices have been pointed upwards, with plenty of room upwards on the technical charts

*

Medium to longer-term forecasts this year have largely called for ranges from $30 to $100 in extreme scenarios. Of course, there is a lot of ground to cover until either of these figures can be reached, though there are a lot of factors silver is benefitting from.

*

Tailwinds and Economic Benefits

*

Silver is a strong instrument to own during periods of inflation. With central banks worldwide intent on printing more money to help kindle a recovery from Covid-19, inflationary concerns are once again in the spotlight.

Silver stands to be a prime beneficiary of this, with hard assets such as precious metals always maintaining their luster during these periods.

As an asset, however, Silver remains vastly undervalued at current levels, given other macro-economic alternatives to choose from.

Renewed stimulus measures in the United States, Europe, Asia, and elsewhere in the world only add to the strength of Silver moving forward, making it difficult not to be bullish on silver prospects.

A groundswell of liquidity is quite likely to push inflation levels higher, setting up silver as a solid play in 2021.

*

Industrial Demand Coming Back

*

In 2020 many countries saw a huge hit to industrial output and activity. The lingering effects of Covid-19 are still raging in many developed countries despite the rollout of vaccines, though the industry is expected to normalize later this year.

This is a huge boon for silver given its status as an industrial metal. Furthermore, silver is seen as a key player in many specific segments that are expected to draw renewed interest.

This includes the solar industry, with the incoming Biden administration in the United States largely expected to focus more on during the new decade.

With supply constraints looming by virtue of an absence of physical markets, the demand for silver is likely to increase.

Prices have continued an upward pattern in February, though have thus far failed to match the earlier surge to $30. This was seen as an artificial bounce, however, technically speaking.

Any renewed progress surrounding the passage of a US stimulus package will help insulate silver prices as well. As long as prices do not breach the $24.00 level, a clear path higher remains intact.

Look for silver prices to grind higher with plenty of chances for entry as the white metal remains one of the most volatile and fickle.

Many investors recall previous surges of prices only to see a quick turnaround and collapse. This rise could be different, kicked off by a total buyout of the physical market which leaves the space in unprecedented territory.

LEGAL DISCLAIMER:

While the author has made every effort to provide accurate data and information in the preparation of this article, neither europabullion.com nor the author assumes any responsibility for errors or for changes that occur after the publication. The information referenced is believed to be reliable, accurate, and appropriate, but is not guaranteed in any way. The strategies and forecasts herein are the author’s sole opinion and could prove to be inaccurate. No company, individual, or entity compensated the author or europabullion.com for mention in this article.

The article contains specific names of companies, strategies, different currencies, shares, government bonds, types, and sizes of precious metals, none of which can be deemed recommendations to the readers. Reading this article does not constitute a fiduciary relationship. Data, company-specific or otherwise, will not be updated on an ongoing basis. After the publication of the resources, the author and europabullion.com will not be responsible for future developments.

A registered financial advisor is always the best source of guidance in making financial decisions. The author is not a registered financial advisor and does not address the individual financial condition of the reader.