Inflation concerns get more and more justified as the days go by.

*

Inflation may be an unavoidable economic fact of modern economic (and everyday) life, but it’s starting to make a lot of people very nervous.

Modern economists, investors, and everyday Joes believe inflation is primed for rapid growth as trillions in federal stimulus spending are layered on top of the Federal Reserve’s rock-bottom rates, a nascent economic recovery, and hordes of newly vaccinated shoppers who are eager to spend.

The question is whether the coming wave of inflation will be a modest, easily managed wave or a dramatic flood that will roil markets, kneecap savers, and cause the Fed to rapidly hike rates, imperiling the recovery.

Many financial professionals aren’t overly concerned that inflation will spiral out of control, especially since the economy has plenty of post-pandemic ground to make up. The administration of President Joe Biden is pinning its hopes on the idea that we’ve moved into an era of easy money without consequences. But is that so?

There are plenty of other observers who worry about a replay of the grim days of stagflation in the late 1970s and early 1980s when inflation spiked and the economy stalled.

The Fed Chairman Jerome Powell declared he would allow prices to rise modestly above their target for a period of time before raising interest rates. “Following periods when inflation has been running below 2%, appropriate monetary policy will likely aim to achieve inflation moderately above 2% for some time,” Powell said last August from Jackson Hole.

At the time, Powell’s stance drew two main questions: How exactly would the Fed get inflation to 2%? And how would it stop inflation from spiraling out of control?

*

What’s Going on with Inflation Now?

*

The first question has become easier to answer than the second. In the first quarter of 2021, the federal government passed nearly $3 trillion in stimulus spending. That’s in addition to the $2.2 trillion passed at the beginning of the pandemic.

To put that in perspective, the fiscal stimulus package enacted after the Great Recession was almost $800 billion, or about $970 billion in today’s dollars (talking about inflation, eh). At the time, this amount was an almost unimaginable sum—but it’s paltry in comparison to the stimulus of the moment.

In the meantime, Americans started getting Covid-19 vaccinations and economic activity began picking up steam. More than 915,000 jobs were added in March and the unemployment rate dropped to 6%, a far cry from its almost-15% peak in April 2020.

In response to these changes, the Fed increased its inflation forecast for 2021 from 1.8% back in December to 2.2% in March. Should Biden pass his $2.3 trillion infrastructure bill, even more money will flow into the economy. The Fed may even have to update its inflation projections with big margins.

*

What Should We Do about Inflation?

*

Normal people are also getting antsy over inflation. Commodities prices are already soaring. That will affect all the people - consumers, savers, and investors. In times like these, we prefer to stay conservative. The precious metals are time-proofed insurance against inflation. This time won’t be different.

*

*

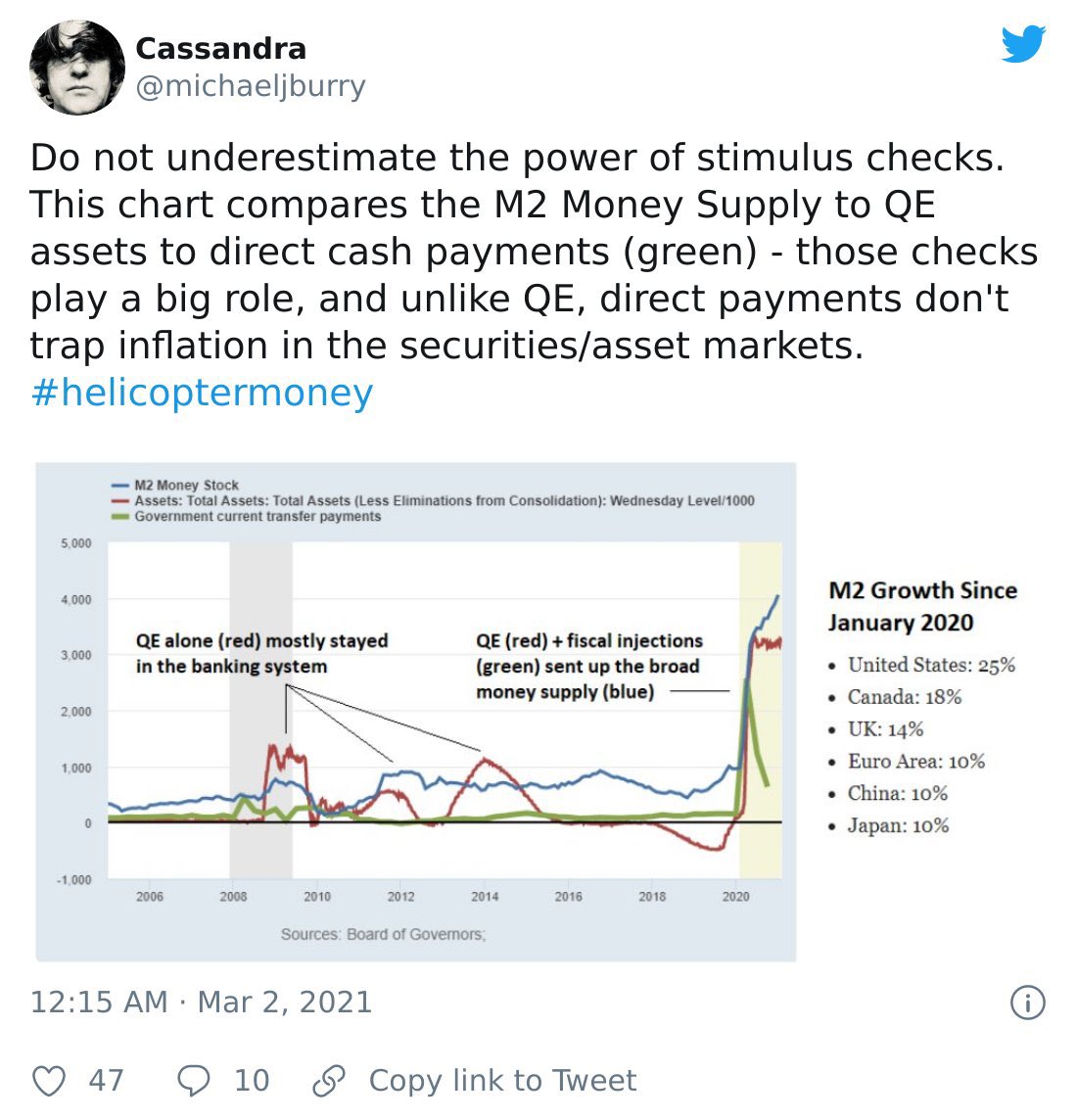

The investing legend Dr. Michael J. Burry (brilliantly portrayed by Christian Bale in the movie Big Short) is also worried about inflation...

*

*

...like a lot.

*

*

*

*

*

Unlimited stimulus without consequences... is that even possible?

*

*

LEGAL DISCLAIMER:

While the author has made every effort to provide accurate data and information in the preparation of this article, neither europabullion.com nor the author assumes any responsibility for errors or for changes that occur after the publication. The information referenced is believed to be reliable, accurate, and appropriate, but is not guaranteed in any way. The strategies and forecasts herein are the author’s sole opinion and could prove to be inaccurate. No company, individual, or entity compensated the author or europabullion.com for mention in this article.

The article contains specific names of companies, strategies, different currencies, shares, government bonds, types, and sizes of precious metals, none of which can be deemed recommendations to the readers. Reading this article does not constitute a fiduciary relationship. Data, company-specific or otherwise, will not be updated on an ongoing basis. After the publication of the resources, the author and europabullion.com will not be responsible for future developments.

A registered financial advisor is always the best source of guidance in making financial decisions. The author is not a registered financial advisor and does not address the individual financial condition of the reader.

*