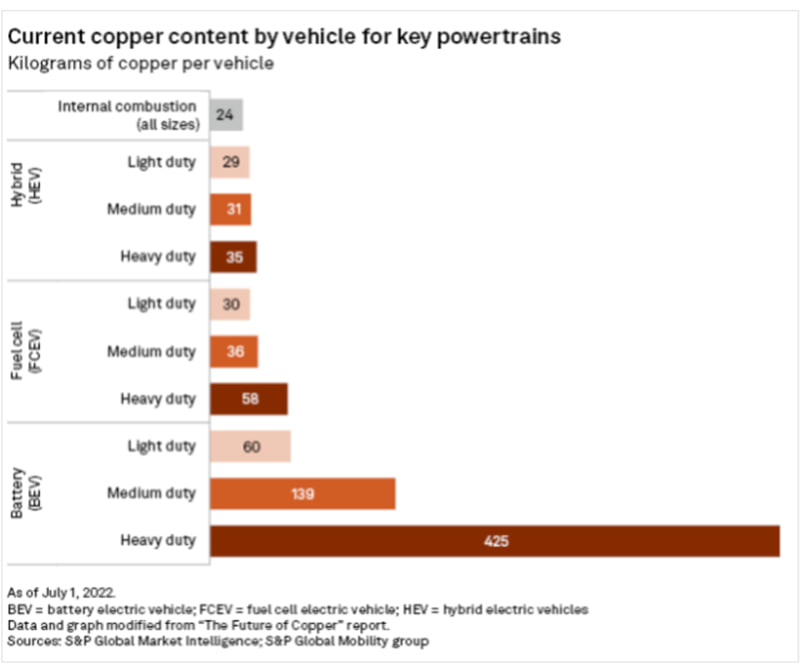

Figure 1: The copper content in a hybrid or battery-electric vehicle ranges from slightly more than an ICE vehicle to substantially more. (Image source: S&P Global)

We’ve been hearing a lot about shortages over the past few years: energy, semiconductors, silver, lumber, lithium, helium, water—it’s a long list (although semiconductor and lumber shortages seem to have eased a great deal in the past year).

There are materials experiencing an increase in demand with little to no increase in availability, such as copper. Yes, that easy-to-refine metal that has been used for thousands of years is now on the “worry list.”

Despite copper’s many uses, from PC boards to interconnects, it doesn’t get the same attention as ICs or rare earths since it’s often considered “old news” and mundane—yet it’s the third most widely used metal in the world, after iron and aluminum. Copper has many useful and advantageous mechanical, chemical, and electrical properties, and it’s one of the last materials to get attention from EEs. After all, it has the lowest resistivity of any non-precious metal and is second only to silver in conductivity among all metals.

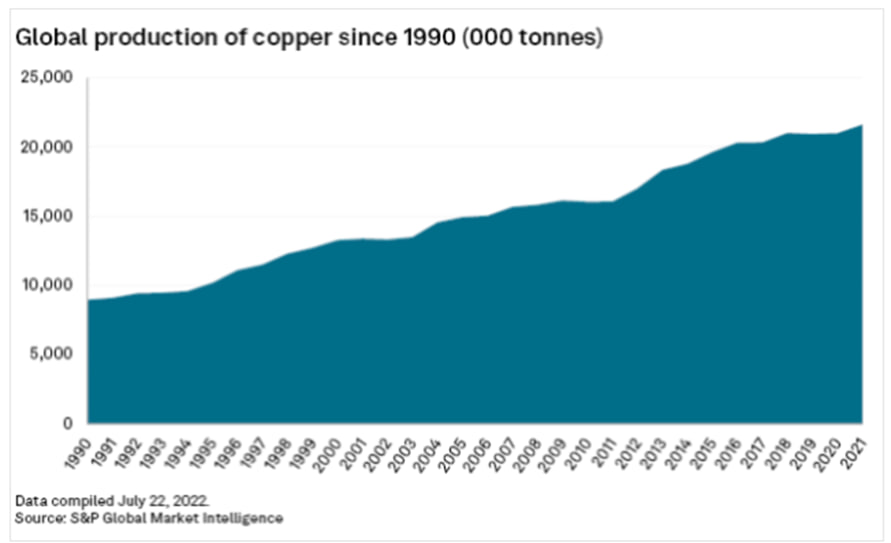

Figure 2: Global copper production has more than doubled since 1990. (Image source: S&P Global)

Increased demand for copper

There are many reasons for the anticipated surge in copper demand. Perhaps most visible are the needs of electric vehicles (EVs), which require much more copper per vehicle compared to internal combustion engine (ICE) vehicles. Then there’s the overall push for increased electrification from top to bottom, including consumer ranges, EV charging stations, and high-voltage transmission lines, and renewable sources like wind farms.

Numbers tell the story, and for basic commodities like copper, there are lots of them available from various sources and perspectives—unlike some other market numbers, which are at best-educated guesses, these numbers seem to have reasonably good credibility.

Will copper supplies grow?

The big question is, to what extent will production continue to grow? Getting more copper ore isn’t easy—you can only extract copper where there’s available ore. Chile accounts for over one-third of the world’s copper production, followed by Peru, the Democratic Republic of the Congo, China, United States, Australia, Indonesia, Zambia, Canada, and Poland. A huge mine just opened in the Gobi Desert of Mongolia this year, so its output isn’t listed yet. The largest copper importers are China, Japan, India, South Korea and Germany.

Promising new locations for mining copper ore doesn’t just happen—they must be found and assessed. Meanwhile, the ore quality at existing sites is decreasing as the mines are played out, so extraction is more costly. Getting a copper mine up and running takes at least 10 years and $5-10 billion dollars—that’s longer than a semiconductor fab and roughly the same cost.

Furthermore, the associated environmental issues, impact, and footprint are enormous, as is the infrastructure needed for a viable mine, including roads, huge amounts of electricity, an airport, housing for thousands, and much more. While recycling copper sounds like a partial answer, the reality is that available sources of copper to recycle are limited—not to mention the recycling process is both a costly and complex process.

Given these factors, how much will the demand for copper grow in the next few years and decades? There are many forecasts and opinions, ranging from 5-35% depending on which “expert” you follow. After all, as Yogi Berra, the American professional baseball catcher, said, “Predictions are very difficult to make, especially about the future.” Regardless of the specific number, there’s little doubt that the demand for copper will grow significantly, while its availability will be limited by nature and the increasing cost of extracting, as well as handling, refining, purifying, and fabricating it into whatever final form it needs to have.

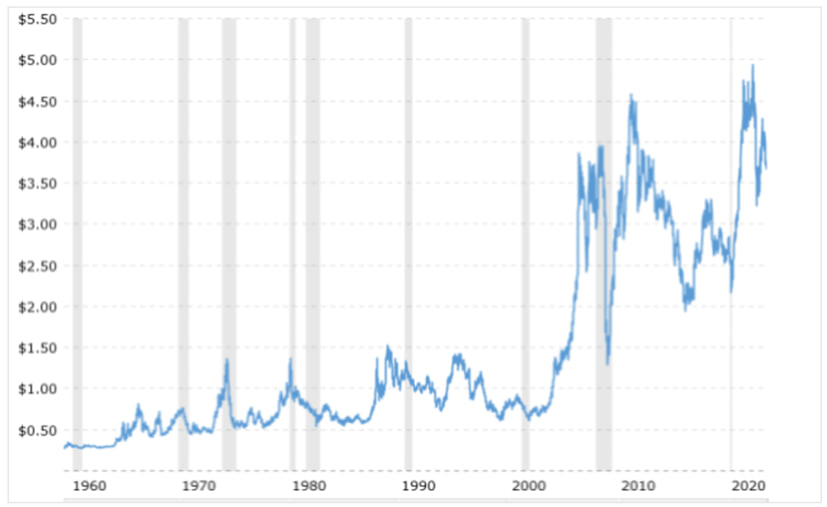

Figure 3: The price of copper (not adjusted for inflation) took a major leap around 2008; the gray vertical bars represent periods of economic recession. (Image source: MacroTrends)

LEGAL DISCLAIMER:

While the author has made every effort to provide accurate data and information in the preparation of this article, neither europabullion.com nor the author assumes any responsibility for errors or for changes that occur after the publication. The information referenced is believed to be reliable, accurate, and appropriate, but is not guaranteed in any way. The strategies and forecasts herein are the author’s sole opinion and could prove to be inaccurate. No company, individual, or entity compensated the author or europabullion.com for mention in this article.

The article contains specific names of companies, strategies, different currencies, shares, government bonds, types, and sizes of precious metals, none of which can be deemed recommendations to the readers. Reading this article does not constitute a fiduciary relationship. Data, company-specific or otherwise, will not be updated on an ongoing basis. After the publication of the resources, the author and europabullion.com will not be responsible for future developments.

A registered financial advisor is always the best source of guidance in making financial decisions. The author is not a registered financial advisor and does not address the individual financial condition of the reader.