Disastrous Deficits No Longer Matter?12.06.2024

It is predicted that China's GDP will overtake that of the U.S. by the end of the 2020s, to become the largest economy in the world, while some also estimate that BRICS countries will also overtake the U.S. and European Union combined around the middle of the century.

The U.

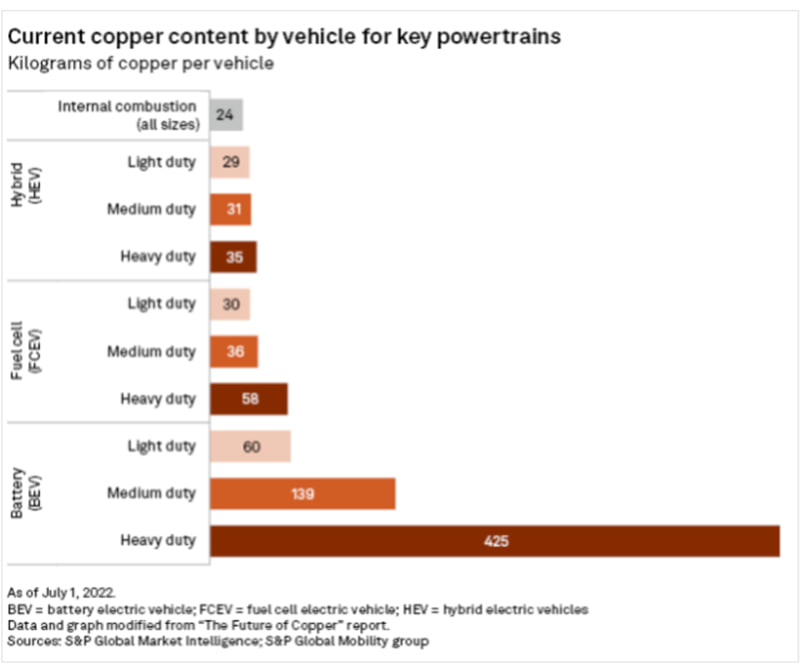

Copper May Be The Next Real Shortage15.08.2023

Figure 1: The copper content in a hybrid or battery-electric vehicle ranges from slightly more than an ICE vehicle to substantially more. (Image source: S&P Global)

We’ve been hearing a lot about shortages over the past few years: energy, semiconductors, silver, lumber, lithium, helium, water—it’s a long list (although semiconductor and lumber shortages seem to have eased a great deal in the past year).

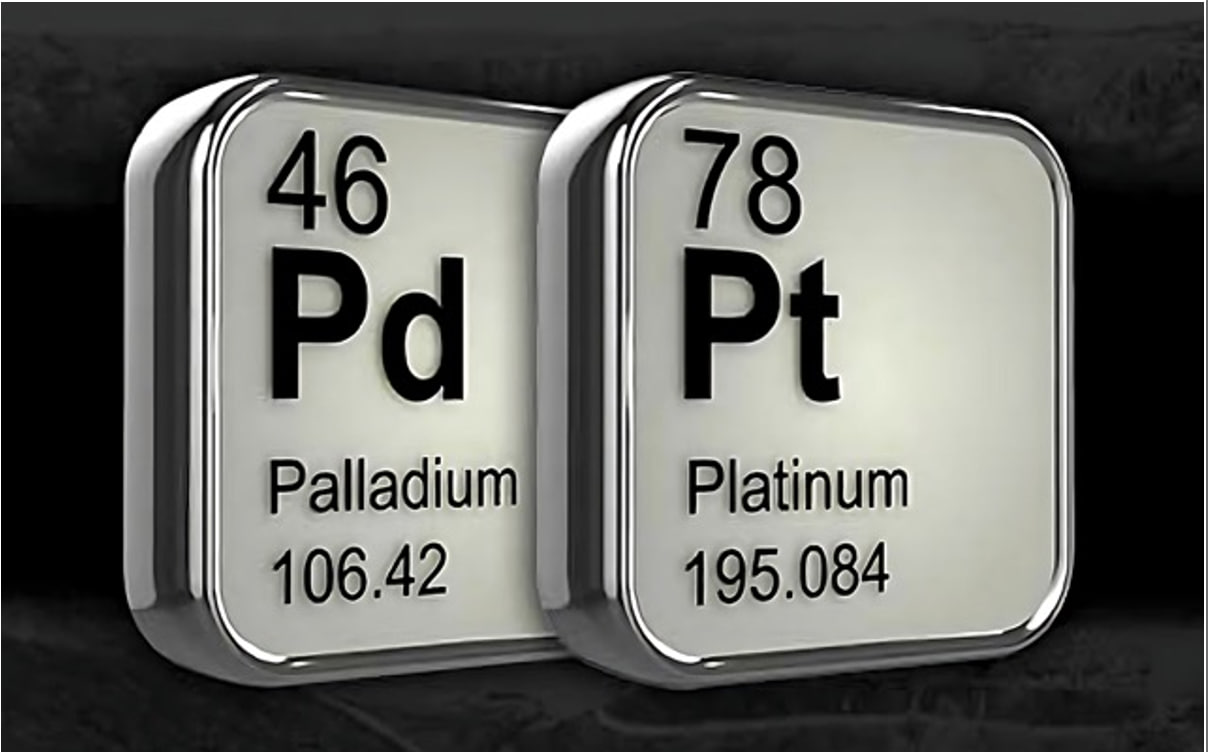

Alternative Investing In PGMs27.07.2023

Platinum and palladium are good alternatives to classic silver and gold products.

Silver and gold dominate the precious metal investment market and are likely to continue to do so into the foreseeable future. However, PGMs are increasingly emerging as significant additions to investment portfolios, offering investors attractive opportunities to diversify their existing holdings and gain more complete coverage of the spectrum of precious metals.

A Currency Board Linked To Gold10.07.2023

Nobody has found some measure of “stable value” that is superior to gold.

It is best to refer to a gold standard as a "currency board linked to gold." This accomplishes quite a few things. It helps people throw out their old misconceptions and look at things from a new perspective. It describes, in five words, how a gold standard actually operates.

The decline of the Turkish lira07.07.2023

Experts say the ‘suppressed’ lira is reaching its true value as they forecast a continued fall against the dollar.

Turkish President Recep Tayyip Erdogan’s historic run-off re-election raised hopes for economic stability and appreciation of the Turkish lira against the US dollar. However, after the vote, the lira’s value continued rapid decline.

The US Federal Reserve is flying BLIND into recession without the MONEY SUPPLY on its altimeter28.06.2023

Steve H. Hanke is a professor of applied economics at the John Hopkins University at Baltimore, Maryland, USA.

The Fed is flying blind into a recession without the money supply on its altimeter. Instead, it is using lagging indicators to justify a monetary crunch not seen since 1938. It’s just one Fed blunder after another. The result always will be surprising them and the markets.

International Silver EPIC Unboxing! by Bullion Now19.12.2022

A Brand of Silver we haven't seen before! - International Silver EPIC Unboxing!

Review by Bullion Now

LEGAL DISCLAIMER:

While the author has made every effort to provide accurate data and information in the preparation of this article, neither europabullion.com nor the author assumes any responsibility for errors or for changes that occur after the publication.

Banki KUPUJĄ ZŁOTO, czy Ty też powinieneś?14.11.2022

Banki KUPUJĄ ZŁOTO, czy Ty też powinieneś?

By Moneciarz

LEGAL DISCLAIMER:

While the author has made every effort to provide accurate data and information in the preparation of this article, neither europabullion.com nor the author assumes any responsibility for errors or for changes that occur after the publication. The information referenced is believed to be reliable, accurate, and appropriate, but is not guaranteed in any way.

Bull & Bear Silver Coin Review by Andorrano Joyeria21.10.2022

Moneda de Plata TORO Y OSO 2022 1 oz

Review by Andorrano Joyeria

LEGAL DISCLAIMER:

While the author has made every effort to provide accurate data and information in the preparation of this article, neither europabullion.com nor the author assumes any responsibility for errors or for changes that occur after the publication. The information referenced is believed to be reliable, accurate, and appropriate, but is not guaranteed in any way.

Are You Holding On To These Valuable Metals?26.09.2022

MY THOUGHTS ON SILVER & GOLD'S RECENT PRICE MOVEMENTS - Are You Holding On To These Valuable Metals?

by Backyard Bullion

LEGAL DISCLAIMER:

While the author has made every effort to provide accurate data and information in the preparation of this article, neither europabullion.com nor the author assumes any responsibility for errors or for changes that occur after the publication.

1 Oz Bull & Bear Silver Coin Review By ZIEMANN VALOR28.08.2022

1 OZ BULL & BEAR SILVER COIN

Review by Ziemann Valor

LEGAL DISCLAIMER:

While the author has made every effort to provide accurate data and information in the preparation of this article, neither europabullion.com nor the author assumes any responsibility for errors or for changes that occur after the publication. The information referenced is believed to be reliable, accurate, and appropriate, but is not guaranteed in any way.

BULL & BEAR Bullion Coin Review by Swan Bullion27.07.2022

BULL & BEAR Bullion Coin Review by Swan Bullion

The best Silver Bullion to stack in 2022? - Coins from Europa Bullion

Product Review by Austrian Stacker

LEGAL DISCLAIMER:

While the author has made every effort to provide accurate data and information in the preparation of this article, neither europabullion.com nor the author assumes any responsibility for errors or for changes that occur after the publication.

Bull & Bear Silver Coin Review By Swan Bullion05.04.2022

1 Oz Bull & Bear 2022 Silver Coin Review

by SWAN BULLION

LEGAL DISCLAIMER:

While the author has made every effort to provide accurate data and information in the preparation of this article, neither europabullion.com nor the author assumes any responsibility for errors or for changes that occur after the publication. The information referenced is believed to be reliable, accurate, and appropriate, but is not guaranteed in any way.

1 Kilo Goddess Europa Silver Coin Bar Review by Moneciarz18.03.2022

Jak tanio kupić 1 KG SREBRA ? - Goddess Europa

1 Kilo Goddess Europa Silver Coin Bar

Review by Moneciarz

LEGAL DISCLAIMER:

While the author has made every effort to provide accurate data and information in the preparation of this article, neither europabullion.com nor the author assumes any responsibility for errors or for changes that occur after the publication.

Coins from Europa Bullion31.01.2021

The best Silver Bullion to stack in 2022? - Coins from Europa Bullion

Product Review by Austrian Stacker

LEGAL DISCLAIMER:

While the author has made every effort to provide accurate data and information in the preparation of this article, neither europabullion.com nor the author assumes any responsibility for errors or for changes that occur after the publication.

In Focus Friday by Backyard Bullion18.01.2022

In Focus Friday by Backyard Bullion

Video review of the 1 oz Starfish and the 1 oz The Cutty Shark Silver Coins

LEGAL DISCLAIMER:

While the author has made every effort to provide accurate data and information in the preparation of this article, neither europabullion.com nor the author assumes any responsibility for errors or for changes that occur after the publication.

1 Oz Bull And Bear Silver Coin Review by Moneciarz03.11.2021

1 Oz Bull And Bear Silver Coin Review by Moneciarz

LEGAL DISCLAIMER:

While the author has made every effort to provide accurate data and information in the preparation of this article, neither europabullion.com nor the author assumes any responsibility for errors or for changes that occur after the publication. The information referenced is believed to be reliable, accurate, and appropriate, but is not guaranteed in any way.

Analysts Say Bullmarket Still On For Precious Metals25.10.2021

ANALYSTS SAY THE BULL MARKET STILL ON FOR PRECIOUS METALS

Bull markets are perceived differently by investors focused both on the long term as well as the short term. In 2019, gold entered a bull market after exiting basing channel at $1,370. Before that, the metal was trading for a little below $2,000 in 2011 and fell to $1,200 in 2013. After this, the metal entered a new channel in 2014, before exiting it once more in 2020.

The Lindy Effect And The Precious Metals11.10.2021

The Lindy Effect

The Lindy effect is a phenomenon by which the future life expectancy of some non-perishable things, like a technology or an idea, is proportional to their current age. The Lindy effect proposes the longer period something has survived to exist or be used in the present, it is also likely to have a longer remaining life expectancy.

Goddess Europa29.09.2021

Goddess Europa - the cheapest silver coin in the world?

Goddess Europa - najtańsza bulionówka na świecie?

Review by Moneciarz

LEGAL DISCLAIMER:

While the author has made every effort to provide accurate data and information in the preparation of this article, neither europabullion.com nor the author assumes any responsibility for errors or for changes that occur after the publication.

1 Oz Bull And Bear Silver Coin Review20.09.2021

A Bear Market For Silver - This Coin's Design Shows The Bear Bullying The Bull by Europa Bullion!

Review by Backyard Bullion

LEGAL DISCLAIMER:

While the author has made every effort to provide accurate data and information in the preparation of this article, neither europabullion.com nor the author assumes any responsibility for errors or for changes that occur after the publication.

A RANT and MOAN about Buying and Selling Gold & Silver16.09.2021

A RANT and MOAN about Buying and Selling Gold & Silver

- Import & Export TAX Woes & Brexit Fallout!

By Backyard Bullion

LEGAL DISCLAIMER:

While the author has made every effort to provide accurate data and information in the preparation of this article, neither europabullion.com nor the author assumes any responsibility for errors or for changes that occur after the publication.

Sometimes the Cheapest Silver is Just the BEST thing to buy30.08.2021

Sometimes the Cheapest Silver is Just the BEST thing to buy - Goddess Europa Coin by Europa Bullion!

Product Review By Backyard Bullion

LEGAL DISCLAIMER:

While the author has made every effort to provide accurate data and information in the preparation of this article, neither europabullion.com nor the author assumes any responsibility for errors or for changes that occur after the publication.

Why Can't I Buy Silver At Spot Price Everyone Keeps Quoting?27.07.2021

How can I buy Spot Silver?

Everybody looks at the charts and here it is - the spot price of the shiny metal. Everything starts and ends just here. Or is it?

Hordes of Silver Stackers all around the world keep track of the Silver Spot Price behind big monitors. The veterans are well accustomed to it, also they are well aware of the specific practices and interventions by the authorities and the big commercial speculators on the market as well.

WHY RATES HIKE IS VERY UNLIKELY?17.06.2021

Jerome Powell is praying for better days in order to raise the rates.

Wednesday’s forecast showed 13 members of the Federal Open Market Committee believe the Fed will increase rates in 2023 and the majority of them believe the central bank will hike at least twice that year.

In fact, seven of the 18 members see the Fed possibly increasing rates as early as 2022.

BIG SUMMER SQUEEZE AT EUROPABULLION.COM11.06.2021

It is always fun to go on a boating trip with all your newly bought Silver loaded on.

Europa Bullion Team is happy to present you with a fresh breeze of the coming summer. Right now from the 11th of June until the 20th of June there is 2 % discount for all Silver and Platinum products:

SILVER COINS

SILVER BARS

PLATINUM PRODUCTS

Please make sure to use the very special promo code SUMMERSQUEEZE2021 while placing your order.

A review of the 1kg Goddess Europa Coin Bar by our friend Backyard Bullion21.05.2021

No shortage of silver here - Europa Bullion makes 600 KILOS Goddess Europa Kilo Silver Coin Bars!

Product Review By Backyard Bullion

LEGAL DISCLAIMER:

While the author has made every effort to provide accurate data and information in the preparation of this article, neither europabullion.com nor the author assumes any responsibility for errors or for changes that occur after the publication.

Should We Be Worried About Inflation?04.05.2021

Inflation concerns get more and more justified as the days go by.

Inflation may be an unavoidable economic fact of modern economic (and everyday) life, but it’s starting to make a lot of people very nervous.

Modern economists, investors, and everyday Joes believe inflation is primed for rapid growth as trillions in federal stimulus spending are layered on top of the Federal Reserve’s rock-bottom rates, a nascent economic recovery, and hordes of newly vaccinated shoppers who are eager to spend.

The pandemic changed the world and gold price will reap the benefits27.04.2021

The pandemic changed the world and gold price will reap the benefits

By Anna Golubova of kitco.com

After a record year, gold is bound to see more gains in the medium and long-term, according to the CPM’s Gold Yearbook.

The pandemic has changed the world, making some of the existing problems even worse and setting gold up to benefit, the CPM Group said.

Silver Outlook: What’s in Store for the White Metal?21.04.2021

1 KG GODDESS EUROPA SILVER COIN BAR 999.9

Silver has benefitted from a buyout of the physical market and will continue to do so moving forward.

Silver has remained in the spotlight for several reasons. Kicking off the beginning of the year was a historic level of volatility in the physical silver space, with coordinated attention coming from Reddit via Wall Street Silver.

The few words on money in the U.S. Constitution say more than we know13.04.2021

THE FEW WORDS ON MONEY IN THE U.S. CONSTITUTION SAY MORE THAN WE KNOW

By Brian Domitrovic

The U.S. Constitution was very innovative back in the day..

Mining Companies And Analysts Forecast06.04.2021

MINING COMPANIES AND ANALYSTS FORECAST A NEW RALLY IN THE PRICE OF GOLD, SILVER & PLATINUM FOR THIS YEAR

By Jose Angel Pedraza

The “exuberance” in the financial markets and the interest of investors to accumulate assets that lack real value is the ideal breeding ground for the price of gold to experience a new rally that returns it to its maximum levels. These are the opinions of Mark Bristow, CEO of the world’s second-largest gold miner, Canadian Barrick Gold, in a recent forum organized by the Prospectors and Developers Association of Canada (PDAC).

Gold Price Can Still Get To $2,00030.03.2021

GOLD PRICE CAN STILL GET TO $2,000 AS REAL RATES REMAIN NEGATIVE. FOR INVESTORS LOOKING FOR EVEN MORE GAINS IN THE PRECIOUS METALS MARKET, CPM GROUP VICE PRESIDENT OF RESEARCH ROHIT SAVANT SAID THEY WOULD DO BETTER LOOKING AT SILVER AND PLATINUM.

By Neils Christensen of kitco.com

Rising bond yields have taken a significant bite out of the Gold market this year, but investors shouldn’t fear increasing nominal yields as real interest rates will remain negative for the foreseeable future, according to Rohit Savant, CPM Group’s vice president of research.

Why Central Banks Are Buying So Much Gold?18.03.2021

Central banks are stacking gold hard.

The global economy was flashing danger signs long before the pandemic. For one thing, many countries were clamoring to get hold of as much gold as possible. For the past decade, they have been buying new reserves and bringing them home from overseas storage to an extent never seen in modern times. Then just before the pandemic, there was a pause.

The Great Definancialization10.03.2021

THE GREAT DEFINANCIALIZATION

By Parker Lewis

Or maybe just get a grip on the real money?

Have you ever had a financial advisor (or maybe even a parent) tell you that you need to make your money grow? This idea has been so hardwired in the minds of hard-working people all over the world that it has become practically second nature to the very idea of work.

The line has been repeated so many times that it is now a de facto part of the working culture.

Bullish on Silver both short term and long term03.03.2021

Reddit’s Wall Street Silver is quite an interesting place to be right now.

On a short-term basis, silver has been discovered and re-discovered by a wide range of investors, sell-side marketing groups, and buy-side retail and institutional investors. Some fund managers and investors are liquidating their short to intermediate-term gold positions and buying silver instead, assuming gold may take a breather in its upward march while silver will play catch up.

Global Silver Demand Forecasted to Rise 11% in 2021, reaching 1.025 Billion Ounces22.02.2021

The Silver Institute is the silver industry’s principal voice in expanding public awareness of the importance of silver to modern society. Among its mandates is to provide the global market with reliable statistics and information on silver, and to create and execute programs that help drive silver demand. For more information on silver and the Silver Institute, please visit www.

Why To Hold Physical?16.02.2021

There are over 500 hundred derivatives trading for every single ounce of silver pulled out of the ground.

Nowadays we have bloated debt in every segment of society. The US dollar, the world reserve currency, is vulnerable. For the first time in Fed’s history, the chairman Jay Powell is publicly stating that the Fed is stimulating inflation. We have all of this with a silver market that is incredibly small.

Europeans have treasured the grey metal for millennia10.02.2021

A one-quarter-ounce silver bullion coin made by the U.K.'s Royal Mint in 2013.

We can agree that silver is useful. It was one of the first five metals used by humans (the others being gold, copper, lead, and iron), and readers in North America will be familiar with silver’s monetary and industrial applications. The latter are shaped by silver being the most reflective metal, and it having the highest electrical conductivity of any element and the greatest thermal conductivity of any metal.

Too Big to Fail or Too Small to Bail?03.02.2021

What goes up but never comes down?

Lehman Brothers filed for bankruptcy on September 15, 2008. Hundreds of employees, mostly dressed in business suits, left the bank's offices one by one with boxes in their hands. It was a somber reminder that nothing is forever—even in the richness of the financial and investment world.

At the time of its collapse, Lehman was the fourth-largest investment bank in the United States with 25,000 employees worldwide.

Precious metals and PGM prices forecast to rise in 2021 25.01.2021

Although a change in the U.S. government is unlikely to ease tensions between Washington and Beijing, says CPM Group vice-president of research Rohit Savant, incoming president Biden’s approach to negotiations with China could impact the status of gold and silver under the current administration.

“Hostilities between the U.S. and China will remain irrespective of who is in the White House,” he told The Northern Miner in an email.

World Platinum Investment Council Released Bullish 2021 Platinum Report18.01.2021

The World Platinum Investment Council is extremely bullish for 2021.

The World Platinum Investment Council (WPIC) released a report with a bullish view of the platinum market in 2021.

The WPIC is bullish on the basis of stronger investment demand and restricted production in South Africa.

Platinum in deficit

The WPIC is predicting a record deficit of 1.

NO LONGER A FREE MARKET?12.01.2021

President Richard Nixon was a master of disguise.

On Sunday evening August 15th, 1971 President Richard Nixon officially devalued the savings and earning power of every American citizen. It took only 18 minutes. Almost no one noticed.

Of course, they heard the speech. It aired live on every major radio and television station in the country.

WHAT IS THE REAL MONEY?04.01.2021

‘GOLD IS THE MONEY OF KINGS, SILVER IS THE MONEY OF GENTLEMEN, BARTER IS THE MONEY OF PEASANTS – BUT DEBT IS THE MONEY OF SLAVES.’ – Norm Franz

To be called money a monetary instrument needs to satisfy a couple of requirements.

First, it has to function as a medium of exchange. This means people will readily accept it as payment for goods and services.

Are Silver Milk Spots Really That Much Of A Problem?15.12.2020

With proper treatment, you can get rid of these little devils in less than a minute.

If you are an experienced stacker you already met them. If you are new to the game better be prepared. Holding physical silver is always the best option. Right now in terms of paper claims we are up to numbers as big as 500 paper claims for each physical ounce of silver.

JPMorgan Chase & Co. Agrees To Pay $920 Million in Connection with Schemes to Defraud Precious Metals and U.S. Treasuries Markets07.12.2020

With a lot of sharks out there trying to take a bite of something holding physical is always a great idea.

JPMorgan Chase & Co. (JPMorgan), a New York-based global banking and financial services firm, has entered into a resolution with the Department of Justice of the United States to resolve criminal charges related to two distinct schemes to defraud: the first involving tens of thousands of episodes of unlawful trading in the markets for precious metals futures contracts, and the second involving thousands of episodes of unlawful trading in the markets for U.

The Student Loans Are Never Going To Be Repaid01.12.2020

Student debt boom

Sandy Nurse doesn’t see why she needs to be $120,000 in debt “just for trying to improve my understanding of the world.”

And so, after a decade of struggling to repay her student loans, she plans to stop trying. She hopes others will join her, too, in a national strike against the USA’s outstanding student loan debt, which is marching toward $1.

QE INFINITY25.11.2020

The modern-day Merlin pulls out the QE Infinity spell from his pocket.

In September 2019, the Federal Reserve began conducting its fourth quantitative easing operation since the 2008 financial crisis; on 15 March 2020, it announced approximately $700 billion in new quantitative easing via asset purchases to support US liquidity in response to the COVID-19 pandemic.

Safe Haven20.11.2020

The precious metals are simple. This is the only asset class that doesn’t depend on something else for its value. Stocks depend on a company’s profit, at least that’s how it was supposed to be. Bonds depend on a coupon payment. Apartments need rent-paying tenants. The precious metals need nothing.

WHEN PORN STARS BECAME STOCK PIТCHERS?12.11.2020

The famous urban legend goes that it was the winter of 1928 when JFK’s father, Joe Kennedy, was said to have received a stock tip from a shoeshine boy – ‘Buy Zeppelin’. The story goes that Joe went straight to his office and sold everything, reasoning that it must be time to sell when the shoeshine boy gives you stock tips.

This is how a prosperous tech stock burns to the ground.

AUSTERITY IS NOW A DIRTY WORD03.11.2020

In his last appearance from Jackson Hole the Fed chairman Jerome Powell has delivered a brand new approach to monetary policy for the central bank: it will tolerate inflation rising above 2 % for ‘short periods of time’. This means the Fed will likely be more comfortable keeping its extraordinary stimulus measures in place for longer as it waits for the labor market to heat up and the economy to recover.

YOUR GOLD OR YOUR LIFE!19.10.2020

Mr. Smith was a big believer in the sound money.

In 1776 an inspiring Scottish intellectual came up with what appears to be one of the most influential economic books in the history of Mankind. The Wealth of Nations became a stepping stone for modern economics. In his monumental work, Adam Smith really insightful and way ahead of his time explained now widely accepted concepts such as supply and demand, ‘the invisible hand’ (aka the free market), the theory of money and banking, etc.

IS THE NEW BULL COMING?12.10.2020

Will the Precious Metals be the Greatest Bull Market of our lifetime?

Summary

US equities today trade at truly record valuations, a full-blown mania. Some asset bubbles are already bursting.

The precious metals mining industry is the one clear industry to directly benefit from this monetary and fiscal indulgence.

The lack of investment in exploration and new gold and silver discoveries is setting up an incredibly bullish scenario for metals.

ARE WE HEADED TOWARD APOCALYPSE?29.09.2020

The Great Depression, ca. 1929

Nothing goes only upwards. At least that is what the popular economic theory and the real-life teach us. The markets go up and down and this is how it is supposed to be.

Not anymore! If you trace history back to the ancient Roman Empire you will see that there are plenty of recessions down the road. Like forest fires, they wipe out bad businesses and punish careless investors making space for new profitable enterprises.

PUT YOUR MONEY WHERE YOUR MOUTH IS!18.09.2020

Warren Buffet is bullish on gold.

As the old saying goes, “put your money where your mouth is”. It is hard to think of a more common cliché yet bulletproofed for years to come. For a couple of decades, the famous investment guru and one of the richest people on the face of the Earth Mr. Warren Buffet was one of the biggest gold critics. With his expertise and influential performance on the markets, he has been de facto the leader of the anti-precious metals investing crowd.

WHY SILVER IS BETTER INVESTMENT THAN GOLD?09.09.2020

Most probably Silver will outperform the Gold in the upcoming Bull Market.

This morning, on the 9th of September, 2020, spot gold opened at $1,928.10 an ounce in Europe while spot silver opened at $26.60 an ounce. In essence, the market thinks that gold is approximately 72.5 times more valuable than silver.