How can I buy Spot Silver?

*

Everybody looks at the charts and here it is - the spot price of the shiny metal. Everything starts and ends just here. Or is it?

*

Hordes of Silver Stackers all around the world keep track of the Silver Spot Price behind big monitors. The veterans are well accustomed to it, also they are well aware of the specific practices and interventions by the authorities and the big commercial speculators on the market as well. However, the newbie is wondering - why the dealer is charging me this much for an ounce? Why can’t I buy it at the spot price?

*

So, where to start? Basically, there are different ways to purchase Silver.

*

One of them is to use the derivative market. These include silver futures, silver options, silver ETFs, CFDs, etc. We wouldn’t be too specific about different derivatives on the market. Worth mentioning is that Silver futures are standardized, exchange-traded contracts in which the contract buyer agrees to take delivery, from the seller, a specific quantity of silver (eg. 5000 ounces) at a predetermined price on future delivery date. These are five standardized 1000 oz Comex Bars. So, this is the way to execute bulk purchases but not really convenient for retail customers. On the other hand, there is reasonable doubt about the reliability of the Silver ETF SLV and the CFDs (Contracts for difference, totally forbidden in the United States) have no Silver backup at all. In this previous article, we discussed the superiority of buying physical metal instead of ETFs: Why To Hold Physical?

*

This time we will try to give you an approximate breakdown of the processes which are forming the end product price. EuropaBullion.com is a bullion dealer but we also produce our own products:

*

The goal is to provide the EU market with the lowest premium Silver Bar & Silver Coin possible with the best quality at the same time. We hope we have achieved it.

*

The first step is to take physical delivery of the metal. Just to put things in perspective for a mintage of 100000 pcs x 1 oz Silver Coin you need 100 standardized 1000 oz Comex Bars (delivery of 20 future contracts). As you can see the physical delivery of the metal is crucial. There is a reasonable argument from some of the https://www.reddit.com/r/Wallstreetsilver/ users that the dealers are market neutral and they open short positions in order to hedge the price risk for their physical inventory which artificially brings down the spot price of the Silver. This is correct. But to some extent. https://europabullion.com/ is one of the few crazy dealers who don’t hedge. We truly believe that Silver is highly undervalued and there is a long, long way to go up in price. Our hedge policy is to refill our inventories as fast as we sell something and this is how we lock up the price. No short positions whatsoever. Europa Bullion is long Silver. Period.

*

If you choose the thorny path of Silver manufacturing, always be sure to buy Silver Grain with the correct assay certificates from a reputable refinery.

*

The second most important thing is to obtain a license from state authorities to mint your coins & bars. The USA buyers & sellers just couldn’t care less about the face value of their products but in Europe, there are important reasons to do it in order to comply with the law.

Let’s suggest that we already took delivery and obtained the required papers from the state. Then we are ready to transport the raw material to the Mint and start processing it. We are blessed to have our own factory and to work with the best professionals in Europe (and why not the whole world). However, the process is demanding and really technically exhausting:

*

*

Work hard, play harder.

*

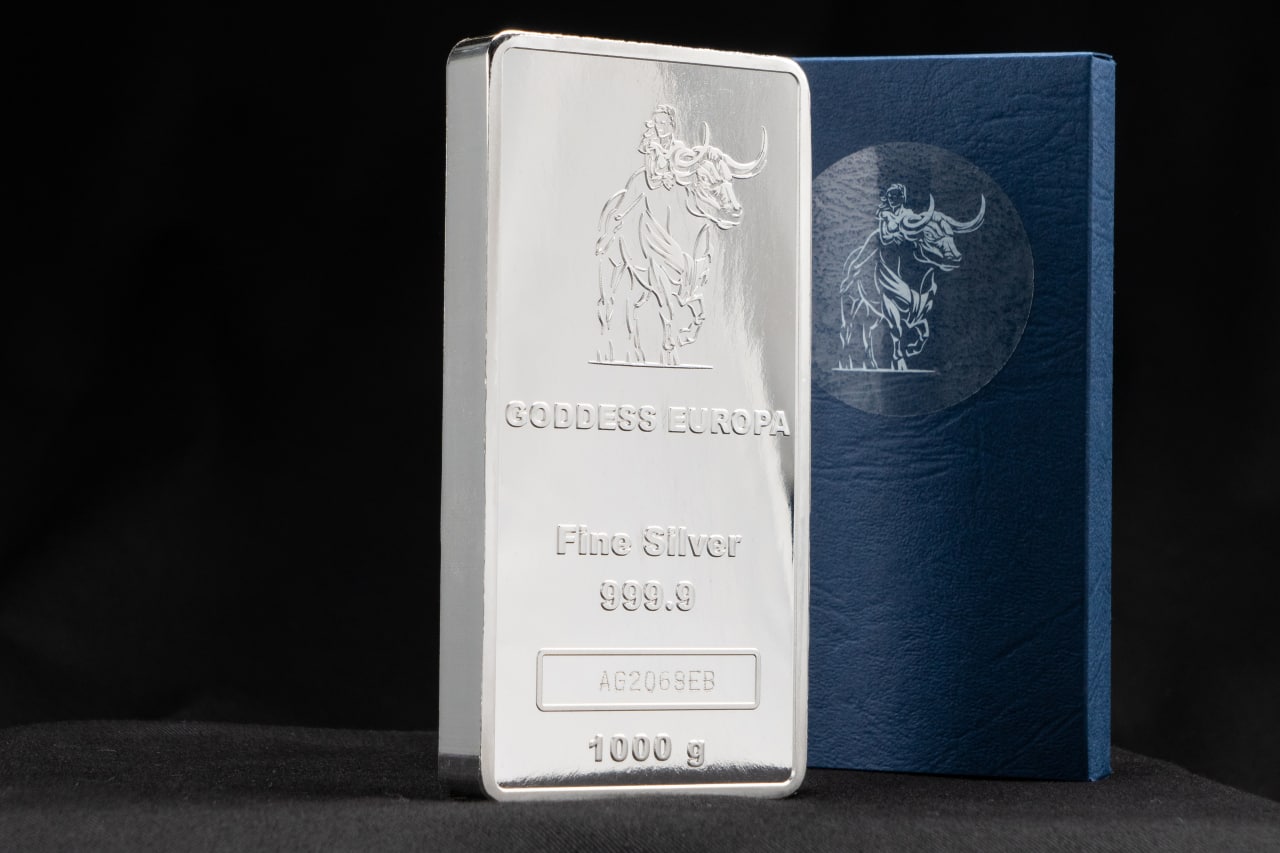

And then, Voila, if we are happy enough we have the end product in our hands:

1 Kg Goddess Europa Silver Coin Bar

*

*

1 Oz Goddess Europa Silver Coin

**

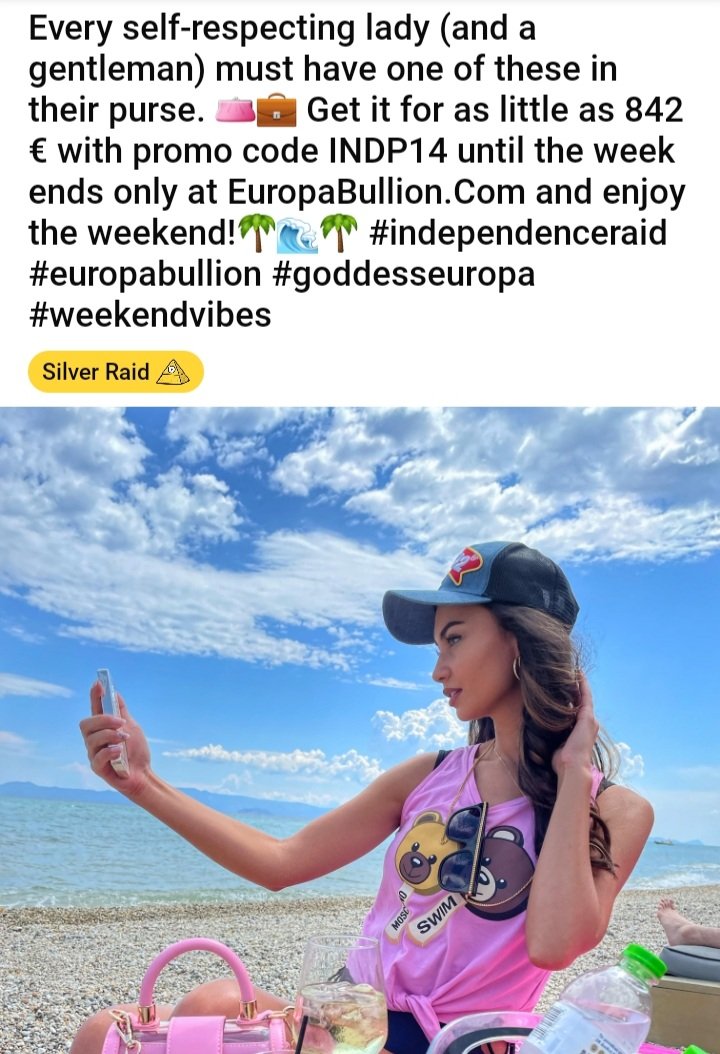

Of course, all of that will be useless without a proper marketing campaign. Our colleague Juliette is happy to be the face of it:

Girls just love Silver. Period.

*

With all of that being said it is a long way to execute the whole supply chain with great proficiency. However, the end-user deserves to buy top-quality products for the best possible price out there. That’s why we strive to provide you with the best prices in Europe. Of course, it couldn’t be the spot price because there are a lot of additional costs before holding the Shiny in your hands. However, some folks put it best: “If you don’t hold it, you don’t own it.” At the end of the day, it is worth all the hassle.

*

*

LEGAL DISCLAIMER:

While the author has made every effort to provide accurate data and information in the preparation of this article, neither europabullion.com nor the author assumes any responsibility for errors or for changes that occur after the publication. The information referenced is believed to be reliable, accurate, and appropriate, but is not guaranteed in any way. The strategies and forecasts herein are the author’s sole opinion and could prove to be inaccurate. No company, individual, or entity compensated the author or europabullion.com for mention in this article.

The article contains specific names of companies, strategies, different currencies, shares, government bonds, types, and sizes of precious metals, none of which can be deemed recommendations to the readers. Reading this article does not constitute a fiduciary relationship. Data, company-specific or otherwise, will not be updated on an ongoing basis. After the publication of the resources, the author and europabullion.com will not be responsible for future developments.

A registered financial advisor is always the best source of guidance in making financial decisions. The author is not a registered financial advisor and does not address the individual financial condition of the reader.

*